Our Story

DELIVERING VALUE TO OUR PARTNERS AND RESIDENTS SINCE 1927

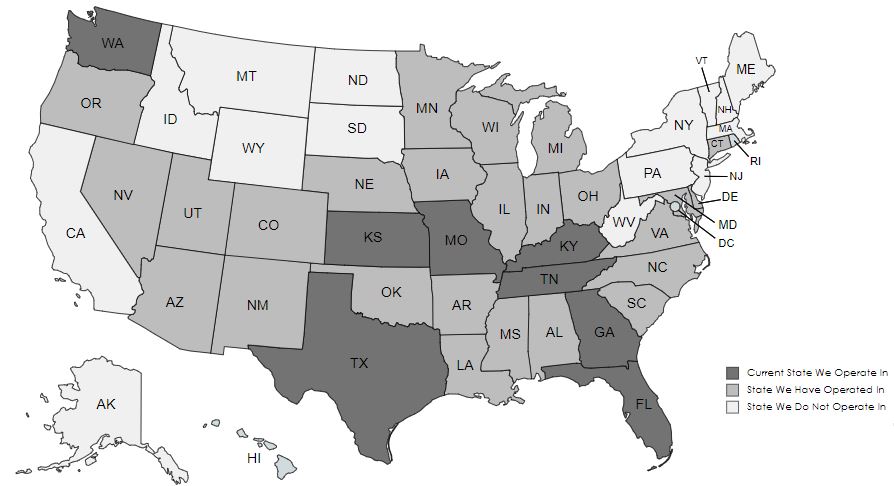

As a leading, privately-held real estate investment firm specializing in the management, leasing, acquisition, construction, and disposition of high quality multifamily and industrial properties around the nation, we acquire for ourselves and in partnership with pension funds, insurance companies, corporations, endowments, and individuals’ core, core-plus, and value-added properties in major metropolitan areas, as well as growth sub-markets.

Throughout our entire history, our investment approach has consistently relied on delivering attractive, risk-adjusted returns with a strong focus on capital preservation and a value creation.

Our track record demonstrates a solid history of strong returns produced by our investment strategies which focus on asset quality, sub-market dynamics, buying opportunities, management expertise, strategic property improvements, and intelligent capital structures.

SOCIAL